Hi, I’m Libor, a guy from the Czech Republic with a passion for trading and a love for music. My journey in trading hasn’t been easy—it’s been filled with mistakes, lessons, and some frustrating setbacks. But eventually, I found the right tools and strategies to make trading work for me. One of those tools is AlgoCloud, which transformed how I approach the markets. Here’s my story of how AlgoCloud helped me finally get consistent results in trading.

Like many traders, my introduction to trading came through flashy ads from forex brokers promising big profits with small deposits. It sounded easy, but reality hit hard when I lost my first deposit within a month. Despite the loss, I was hooked by the idea of making money online. I started studying trading books, browsing forums, and learning everything I could.

I tried day trading futures, specifically e-mini indices, but it was mentally draining. The biggest challenge wasn’t just the technical part—it was dealing with emotions like fear and greed. At times, it felt like trading was consuming me, and I kept breaking my trading rules, which led to more losses.

Frustrated, I turned to automated trading, thinking it would solve the emotional side of trading. I started learning to program strategies in NinjaTrader using C#, but as someone without a programming background, I struggled. Eventually, I gave up, realizing I was spending more time learning to code than trading.

Then, I stumbled upon AlgoCloud—a platform that doesn’t require any coding knowledge. With AlgoCloud’s no-code visual editor, I could create strategies by simply dragging and dropping conditions. No complex coding, just simple logic that I could visually see and understand. This was exactly what I needed to get back to trading without the stress of programming.

My first experience with AlgoCloud was encouraging. I created strategies for stockpicking (choosing individual stocks to trade) using just a few conditions, and I was able to backtest them with real data provided by AlgoCloud. The simplicity of defining two conditions, and having AlgoCloud handle the rest, was a huge relief. I wasn’t spending hours troubleshooting code; I was trading again.

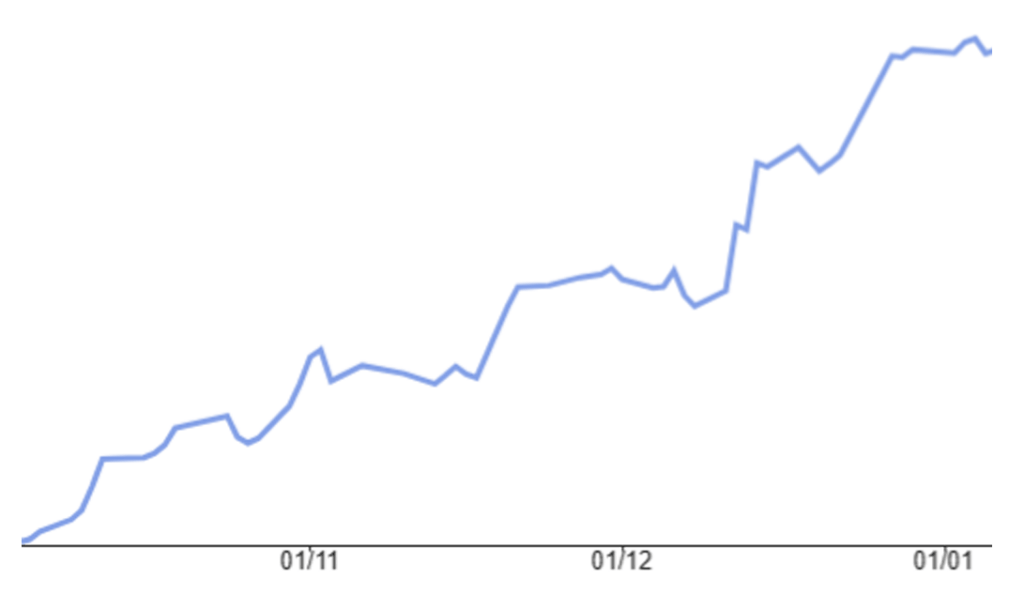

Demo Account Results (October 2023 – December 2023) with a 6% profit over 3 months

After running a few demo tests, I saw a 6% profit after just three months of trading, which was a turning point. Seeing the potential of AlgoCloud, I decided to switch to a live account in early 2024. I started with six strategies, carefully tested, and saw some early success. The strategies worked across thousands of stocks, and I could monitor everything easily without needing to code or worry about data.

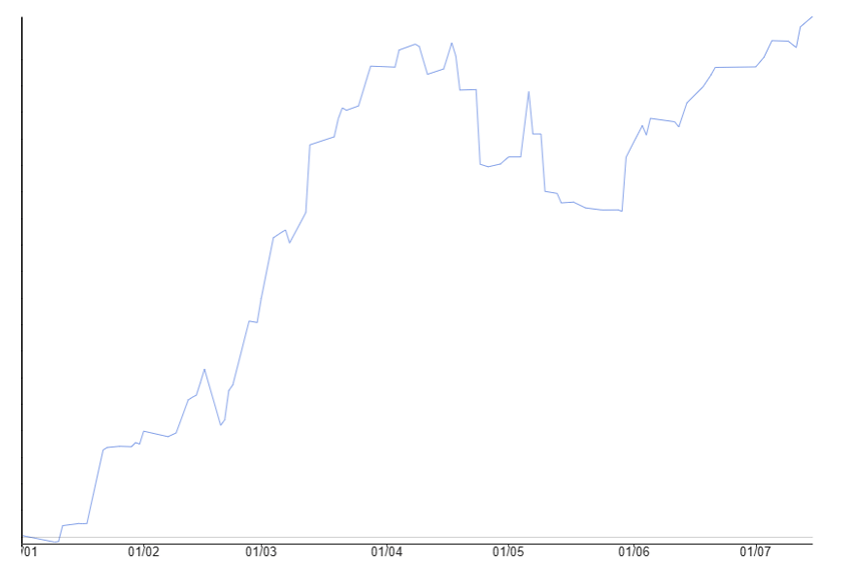

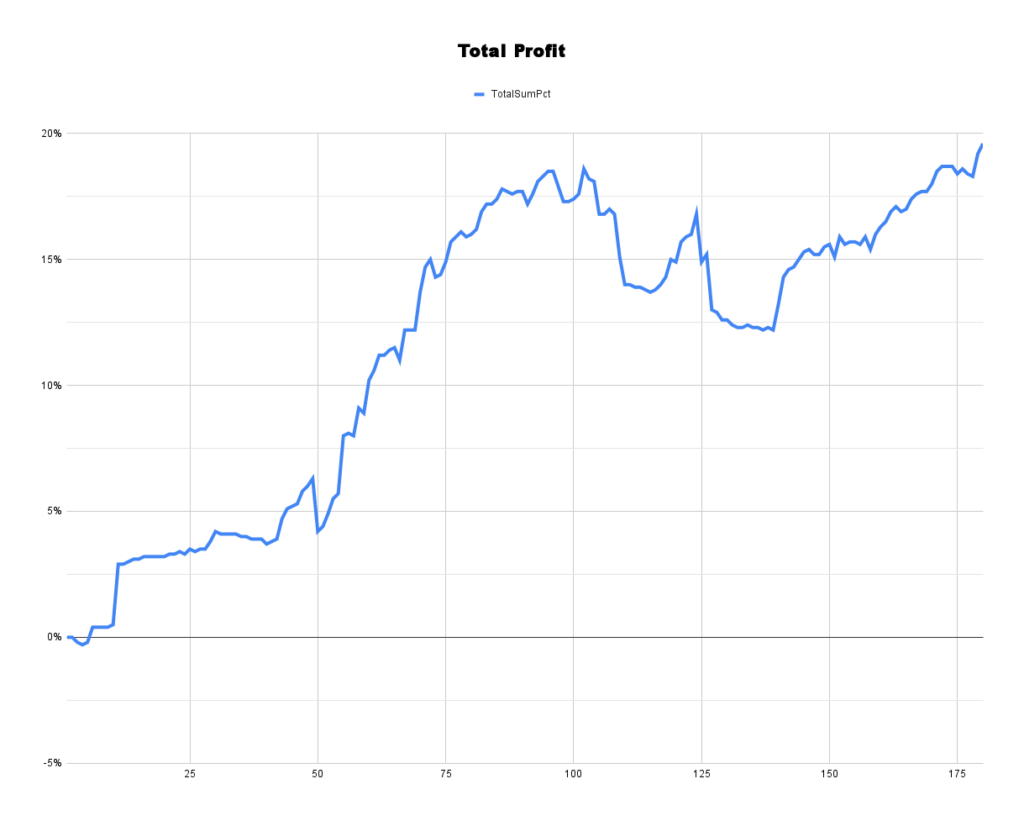

Live Account Results (January 2024 – July 2024) with 19% profit over 6 months

Now, after six months of live trading, my account is up by 19%. There were some moments of drawdown, but AlgoCloud’s stockpicking feature allowed me to stay calm. With a diversified portfolio of stocks, I knew I could weather the drawdowns, and sure enough, my account recovered.

AlgoCloud has given me more than just profits. It’s given me peace of mind. I no longer have to deal with the emotional rollercoaster of trading manually. My strategies run smoothly, and I can trust the process. Meeting the creators of AlgoCloud, I was impressed by how down-to-earth they are. They’re not just developers; they’re traders like me, and they’re constantly working to make AlgoCloud even better.

For me, AlgoCloud was the tool that turned my trading around. If you’re struggling with the same issues I faced—whether it’s emotions or the complexity of coding—this no-code platform might just be the solution you need.

This website is operated by AlgoWizardCloud LLC.

AlgoCloud.com is a technology platform and publisher, not a registered broker-dealer or registered investment adviser, and does not provide investment advice.

Investing involves risk and investments may lose value. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not indicative of future results. Seek appropriate financial, taxation and legal advice before making any investments.

Risk Disclosure:

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Risk Disclosure:

Broker disclaimer:

Interactive Brokers, Alpaca, XTB brokers are not affiliated with AlgoCloud.com and do not endorse or recommend any information or advice provided by AlgoCloud.com