In this article, we’ll explore how one trader, Libor, began trading with a small amount of capital and found potential for meaningful returns. His story shows that a conservative approach and modest starting capital can offer opportunities in trading. Please note that the article below is based on experience of the trader Libor, results might vary for every trader.

Starting with a Conservative Approach

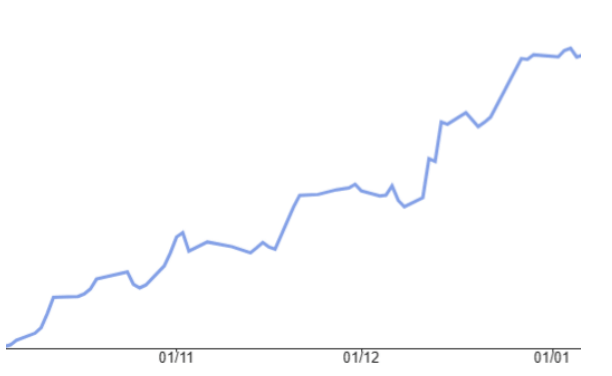

Libor began by first testing his strategies on a demo account. In October 2023, he used three simple strategies to see how they might perform. After three months, his demo account showed a 6% profit with a steady equity curve, encouraging him to transition to live trading.

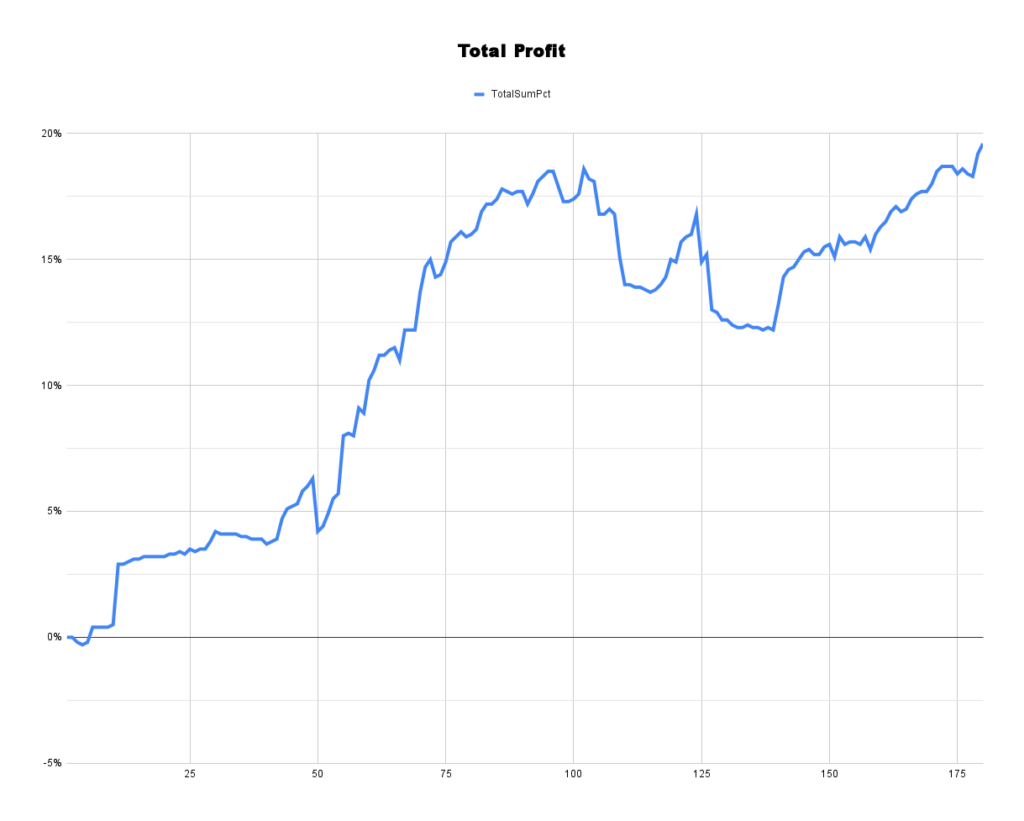

In January 2024, Libor opened a live account with a conservative deposit of $2,000. He launched six strategies and continued monitoring them closely. This cautious approach helped him manage risks while building real-market experience.

Results After Six Months

After six months, Libor’s account had a maximum drawdown of about 5%, which he managed without deviating from his strategies. By July 2024, his account had grown by 19%. While this was a promising result, it’s important to remember that all trading carries risk, and such outcomes are never guaranteed.

Libor’s journey illustrates that trading with a modest amount of capital can offer potential, but it’s not without risk. His story is one example of a structured approach that worked for him, though outcomes will vary for every trader.

This website is operated by AlgoWizardCloud LLC.

AlgoCloud.com is a technology platform and publisher, not a registered broker-dealer or registered investment adviser, and does not provide investment advice.

Investing involves risk and investments may lose value. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not indicative of future results. Seek appropriate financial, taxation and legal advice before making any investments.

Risk Disclosure:

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Risk Disclosure:

Broker disclaimer:

Interactive Brokers, Alpaca, XTB brokers are not affiliated with AlgoCloud.com and do not endorse or recommend any information or advice provided by AlgoCloud.com