The new year is here, and it’s time to pause and reflect. What was last year like? It’s been quite a journey, and I’d like to share my experience with AlgoCloud.

I first came across AlgoCloud sometime in mid-2023. It was love at first sight—I started testing it right away. I created three strategies and deployed them on a test account in the fall. After three months, I had a 6% profit. I detailed this success in one of my earlier articles. That achievement motivated me to start live trading in 2024, and today, I’d like to recap how it went.

Last year was truly a turning point for me. I made decisions that completely transformed my life. The most significant was changing my profession and entering the world of trading. I began focusing on stocks, CFDs, and Futures using strategies I developed with the StrategyQuant tool.

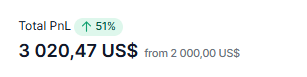

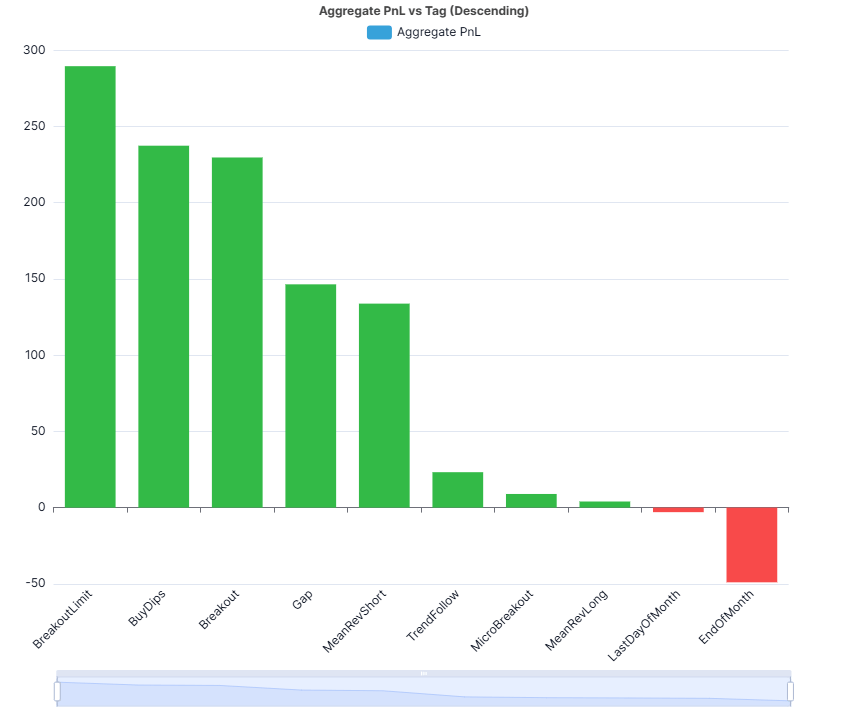

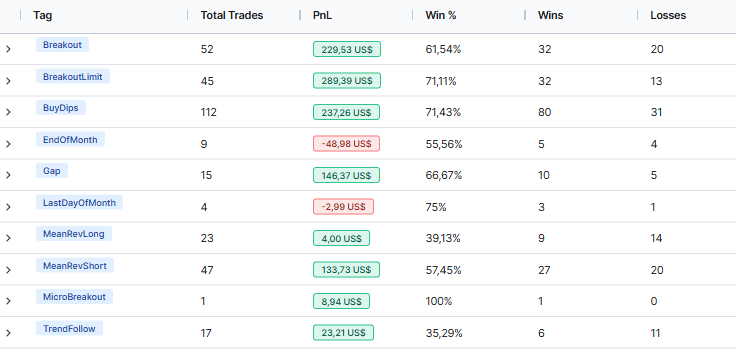

At the beginning of 2024, I opened a live Alpaca account with a $2,000 deposit through AlgoCloud. I started with three strategies that I had thoroughly tested on a demo account. By mid-year, I had added six more strategies to my portfolio.

My initial goal was simple: to finish the year with a profit. Anything above 10% would be a success.

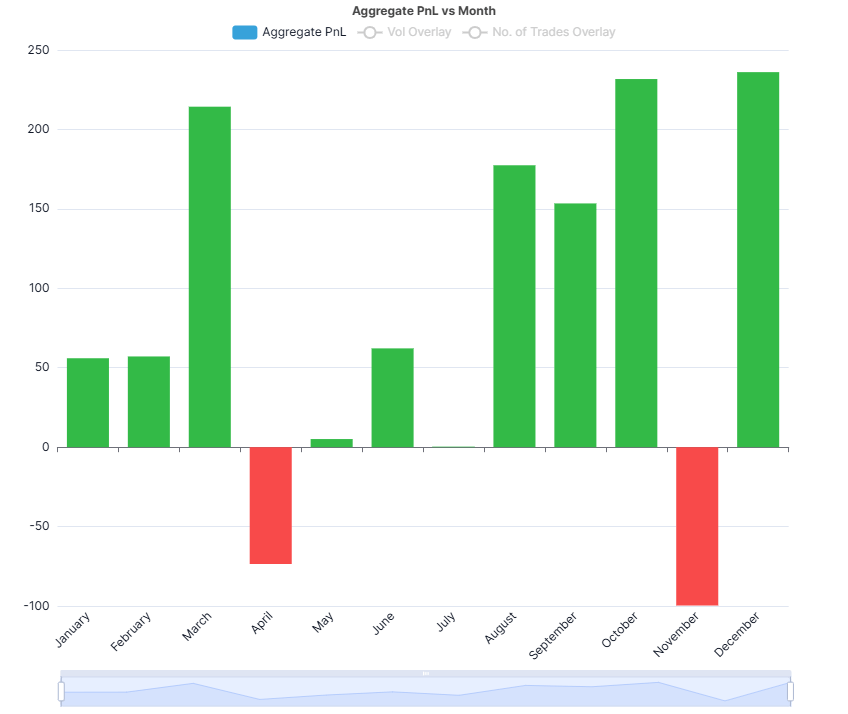

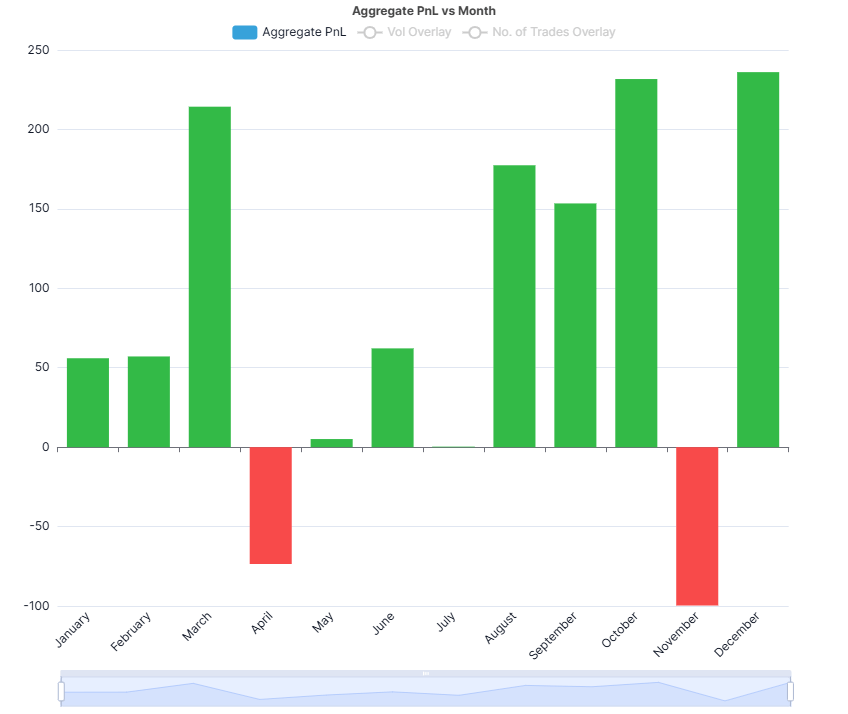

Live account statistics

I don’t have a million-dollar account. I’m just a retail trader aiming to grow my money. I want to show that it’s possible. Stocks don’t need to be intimidating—all you need are a few well-thought-out strategies with an edge, the courage to begin, and the commitment to stick with it.

The steps are straightforward: start by building a simple portfolio of strategies and test them on a demo account. Once you’ve gained confidence in AlgoCloud, nothing stops you from transitioning to live trading. You won’t become rich overnight, but you’ll steadily grow your investments over time.

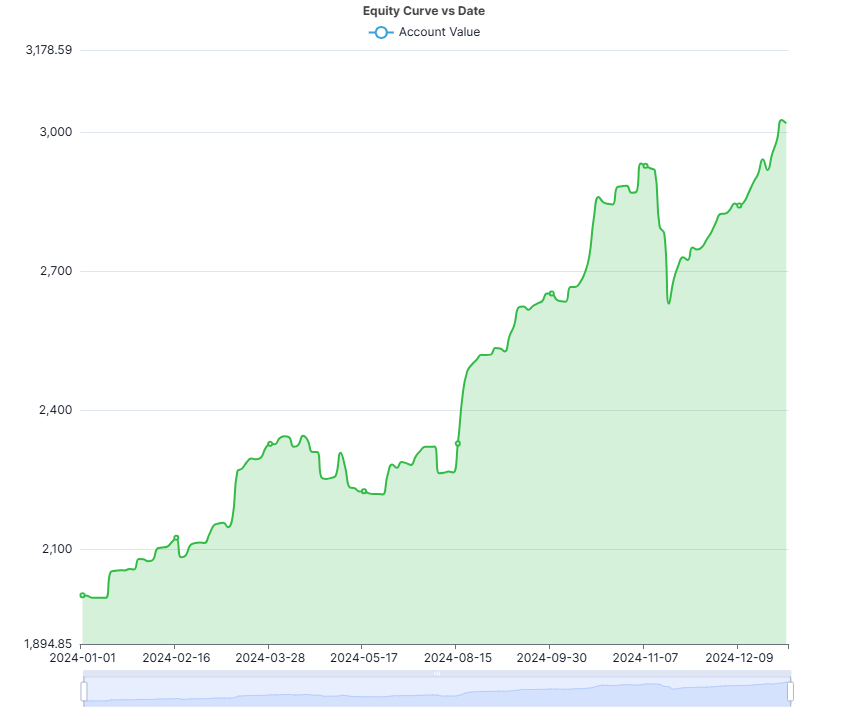

Equity Live account (year 2024)

Example for everyone: 50% profit in a year! This is a number that no bank or fund will offer you. A few years back, I put money into mutual funds. After fees and interest, I made about 1.5% over six years. At that time I said to myself: enough. I took out the money and went looking for a better way to work with it.

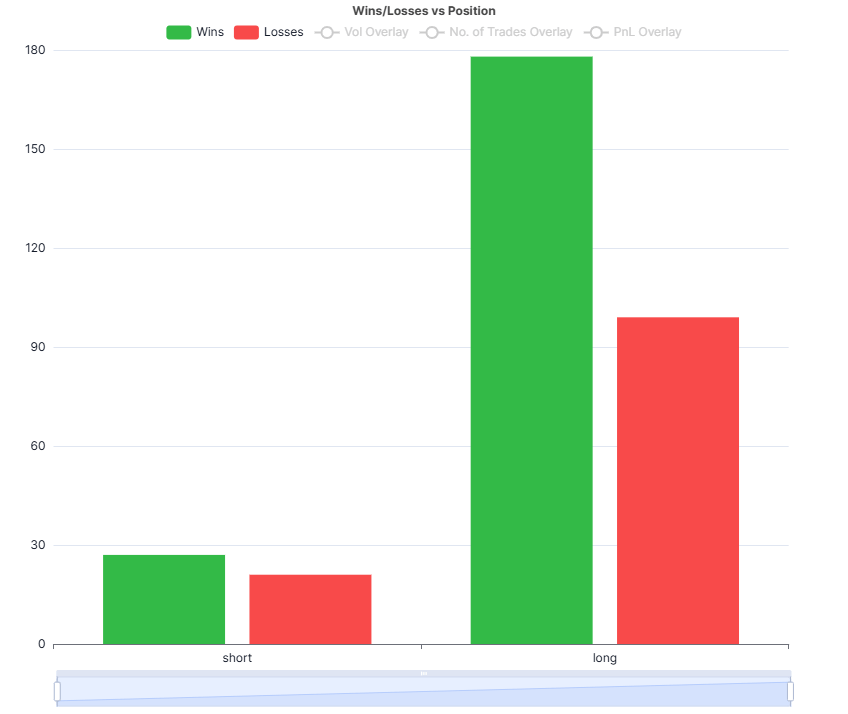

Live trading provides insights that no simulation or demo can match. Last year revealed flaws in my strategies that I hadn’t noticed before. Yes, trading carries risks, but my portfolio is diversified across multiple strategies and thousands of stocks, which minimizes the overall risk.

Last year taught me that making bold changes is always worthwhile, even if it means stepping out of your comfort zone. Trading through AlgoCloud was one of my biggest challenges, and I don’t regret it for a moment.

Next time, we’ll dive into building a small portfolio together. Until then, I wish you good health, happiness, and the courage to pursue your financial goals. Don’t fear investing—it’s worth it!😉

Libor Štěpán

This website is operated by AlgoWizardCloud LLC.

AlgoCloud.com is a technology platform and publisher, not a registered broker-dealer or registered investment adviser, and does not provide investment advice.

Investing involves risk and investments may lose value. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not indicative of future results. Seek appropriate financial, taxation and legal advice before making any investments.

Risk Disclosure:

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Risk Disclosure:

Broker disclaimer:

Interactive Brokers, Alpaca, XTB brokers are not affiliated with AlgoCloud.com and do not endorse or recommend any information or advice provided by AlgoCloud.com